What Is a Reasonable Cause of Late S-Corp Filing? Our full proof example has never been rejected by the IRS.

What Is a Reasonable Cause of Late S-Corp Filing? Our full proof example has never been rejected by the IRS.

Retirement plan options for S-Corporation owners: Maximizing tax benefits and planning for the future.

Clarification on whether S-Corps receive 1099 forms: Understanding the rules and exceptions.

Effective tax strategies for S-Corporations: Planning tips to minimize taxes and optimize financial health.

How to check your IRS Child Tax Credit payments, eligibility, and troubleshooting payment issues.

Maximizing benefits with a triple tax-advantaged Health Savings Account (HSA): Contributions, distributions, and growth.

Requesting an IRS Verification of Non-filing Letter: Steps, uses, and importance for various applications.

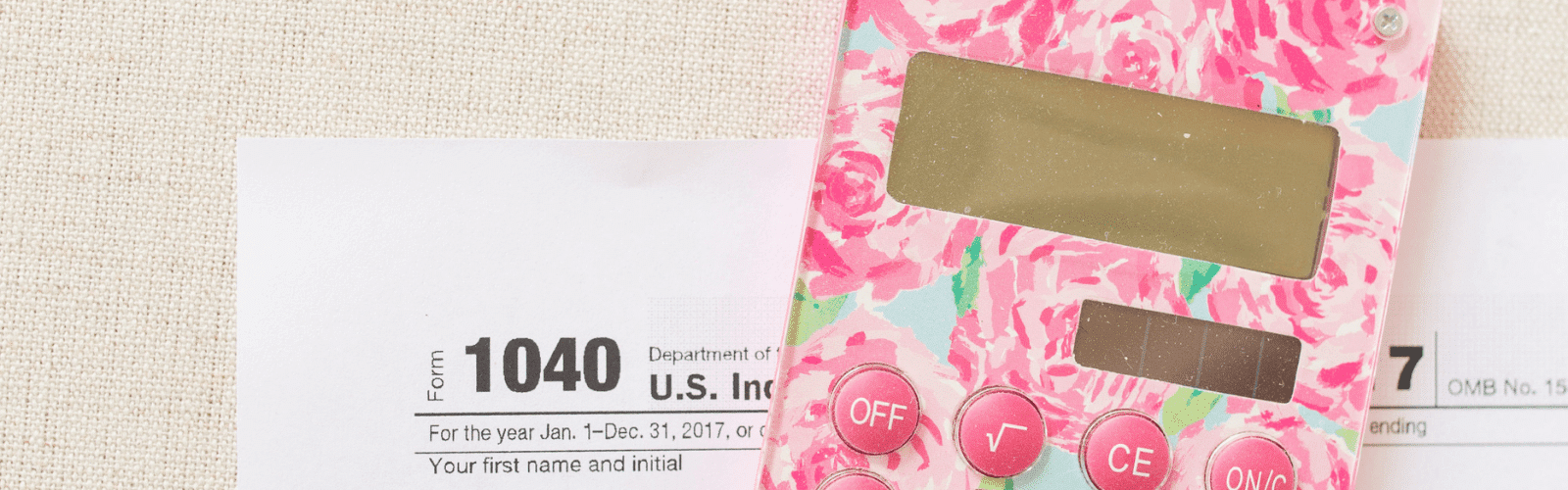

Addressing miscalculations on your 2020 Form 1040: Steps for correction and IRS processes.