Lesson Six

Retirement Contributions

As a small business owner, your focus is keeping your business running smoothly and profitably. But you also need to focus on yourself, and I’m not just talking about the important self-care that we all need now. You also need to think about your future self and what you can do now to make sure that person is set up to live comfortably. To that end, let’s dive into everything you need to know to plan for your retirement.

In lesson six, our goals are:

- Understand the differences between the types of retirement plans options available for the self-employed.

- Decide which type of retirement plan is right for you.

- Determine how much you should contribute each month.

- Understand the available options for S-corporation owners.

Self-Employed Retirement

There are 5 main options available to you as a small business owner:

- Traditional IRA

- Roth IRA

- SEP-IRA

- Simple IRA

- Solo 401(k)

We’ll go over the basics of each type first.

Traditional and Roth IRAs

First of all, if you weren’t sure, IRA stands for Individual Retirement Account. So pretty much anyone with earned income, not just small business owners, can open and contribute to these accounts. Both traditional and Roth IRAs have several things in common:

- You can set up an IRA account fairly easily through a bank, brokerage, or other financial institution.

- You cannot contribute distributions you receive from your company into an IRA (just earned income).

- The total amount per year you can contribute to all traditional and Roth IRAs combined in 2022 is $6,000 if you’re under age 50 and $7,000 if you’re age 50 or older.

One thing that makes traditional IRAs different from Roth IRAs is that with the traditional IRA, you do not pay taxes on your contributions until you withdraw the funds. For that reason, it is usually recommended that you invest in a traditional IRA if you think you’ll be in a lower tax bracket when you retire than you are now.

On the other hand, with a Roth IRA, you will pay your taxes up-front and contribute your after-tax dollars to the Roth IRA. For that reason, it is usually recommended that you invest in a Roth IRA if you’re just starting out and earning less now than you will in retirement.

The other big difference between traditional and Roth IRAs is that with a traditional IRA, you are required to take minimum distributions from your account starting at age 72. This means that you will take a mandatory, taxable withdrawal every year. However, with a Roth IRA, there are no minimum distribution requirements.

The final difference that sets a Roth IRA apart from any other retirement plan we’re discussing is that you can make tax-free and penalty-free withdrawals on your contributions (but not your earnings) whenever you’d like. With other IRA types as well as 401(k)s, you will pay an extra 10% in taxes if you withdraw money from your account before age 59 ½ (with a few rare exceptions).

Simplified Employee Pension IRA (SEP IRA)

The next type of IRA you should know about is the SEP IRA. This is an IRA that is set up by the employer rather than the employee. Any size business can establish a SEP IRA, even if you’re the only employee.

With a SEP IRA, you can contribute up to 25% of each employee’s pay (that includes you!) to the account each year up to a maximum amount set by the IRS. By doing so, you can limit the amount you pay for self-employment taxes.

Let’s look at an example: If you pay yourself a salary of $75,000 and contribute 25% of that salary to your SEP, then you’re only paying self-employment taxes on $56,250. In addition, the contributions you make to the SEP are deductible on your business’ tax return, so you’ll be reducing the company’s federal tax bill too!

The are many benefits to using a SEP IRA:

- It is easy to set up.

- It has low administrative costs.

- It allows for flexibility in how much the employer contributes.

- Employees are always 100% vested in the account, which means they have ownership over their money at all times.

Two important items to note is that with a SEP IRA, the employer must contribute the same percentage of compensation for all eligible employees, and like with traditional IRAs, SEP IRAs require minimum distributions starting at age 72.

Savings Incentive Match PLan for Employees (SIMPLE) IRA

The SIMPLE IRA is another plan available to small business owners for businesses with less than 100 employees. With the SIMPLE IRA, employees make pre-tax contributions up to a maximum amount set by the IRS. Then, the employer can either choose to match that contribution for up to 3% of the employee’s wages or set a 2% nonelective contribution for each eligible employee.

As a business owner, this means you can make pre-tax contributions as an employee and also earn the tax deduction for the contribution as the employer.

The benefits to setting up a SEP IRA are similar to setting up a SIMPLE IRA:

- It is easy to set up.

- It has low administrative costs.

- Employees are always 100% vested in the account, which means they have ownership over their money at all times.

However, one item to note with a SIMPLE IRA is that there are heftier early withdrawal penalties than other types of plans. As is the case with traditional and SEP IRAs, there are minimum distribution requirements starting at age 72 with a SIMPLE IRA as well.

Solo 401(k)

The last plan type for you to consider is the Solo 401(k), which can also be called a One-participant 401(k), Solo-k, or Uni-k. This type of plan is just like a traditional 401(k), which means that as a small business owner, you can make an employee and employer contribution up to a maximum amount set by the IRS.

The main advantage to having a Solo 401(k) is that you’ll also have the flexibility to make post-tax Roth IRA contributions. Another advantage is that the contribution limits are higher than those for the SEP or SIMPLE IRA plans.

Just like with all of the other plans except for the Roth IRA, you will be required to make minimum distributions from your Solo 401(k) starting at age 72.

Which Is Best for You?

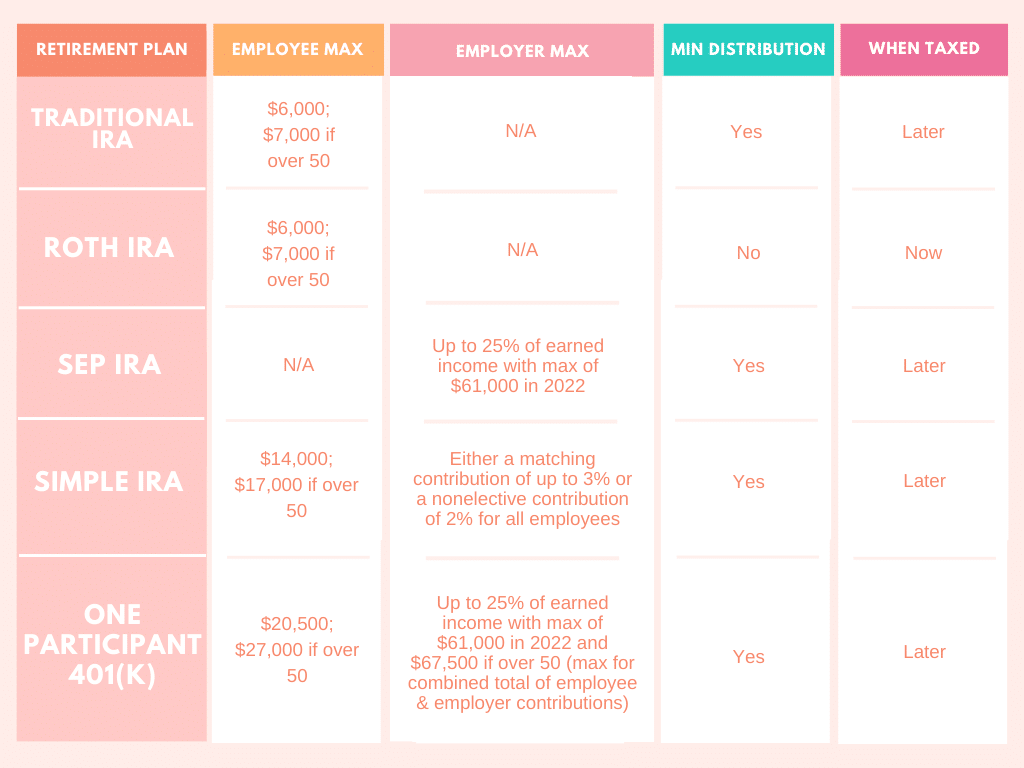

Some other items to consider before deciding upon which retirement plan you’ll choose are the contribution limits and tax filing deadlines. Take a look at this chart to consider the options, and then use our Lesson 6 Checklist to take action and start saving for your bright and fabulous future as a retiree.

| Traditional IRA | Roth IRA | SEP IRA | SIMPLE IRA | Solo 401(k) | |

| Contribution Limit for Employee | $6,000; $7,000 if over age 50 | $6,000; $7,000 if over age 50 | NA | $14,000; $17,000 if over age 50 | $20,500; $27,000 if over age 50 |

| Contribution Limit for Employer | NA | NA | Up to 25% of earned income up to $61,000 in 2022 | A matching contribution up to 3% or a nonelective contribution of 2% for all employees | Up to 25% of earned income with max combined total (employer and employee) of $61,000 in 2022 ($67,500 if over age 50) |

| Deadline | Tax filing deadline for set up and contributing | Tax filing deadline for set up and contributing | Tax filing deadline for set up and contributing | October 1st for set up; December 31st for contributing | December 31st for set up; tax filing deadline for contributing |

| Which is best for you? | Anyone who thinks they’ll be in a lower tax bracket when retired and wants fast and easy | Anyone who thinks they’ll be in a higher tax bracket when retired and wants fast and easy | Self-employed with few or no employees | Larger business with up to 100 employees | Self-employed business owner with no employees (except spouse) |

How Much to Contribute

Coming up with an amount to contribute depends on a lot of factors. Most financial advisors will encourage you to contribute 10-15% of your pre-tax income to your account. However, if you’re just starting your business, this may not be even close to feasible for you. And that’s totally okay!

Just look at your profits each month and contribute as much of those as you think you comfortably can. You can start with a lower amount or percentage each month or each pay period and then increase your contributions as you build your business.

What you can’t do, however, is ignore your retirement and sell yourself short by not preparing for your future!

Retirement Options for the S-Corp Owner

It's important for small business owners to have a plan for retirement.

If you own an S corporation, there are several options available to you. In today's post, I'll give you the lowdown on the five main options so you can think through what's best for your company and your future.

Individual Retirement Account (IRA) and 401(k)

The two most common types of retirement accounts are IRAs and 401(k)s. As an S corporation owner, you can choose from both of those types, and I'll discuss them both in this post.

The two types of IRAs used most commonly by S corporation owners are traditional IRAs and Roth IRAs. These two types of accounts have several things in common, so I'll discuss those first and then I'll let you know what distinguishes one from the other and how that applies to your taxes.

Both traditional and Roth IRAs can be opened by pretty much anyone with taxable income and the accounts can be opened through a bank, brokerage, or other financial institution. As an S corporation shareholder-employee, you can contribute your earned income to these accounts, but you cannot contribute any distributions you receive from the company.

In 2022, the total amount you can contribute to all of your traditional and Roth IRAs combined is up to $6,000 per year if you're under age 50. Those aged 50 and older can contribute an additional $1,000 per year, making the total $7,000 per year for all traditional and Roth IRAs combined.

One important note is that if you withdraw money from a retirement plan, no matter if it's an IRA or 401(k) before you reach the age of 59 ½, that's called an early distribution. Unless you're withdrawing contributions from a Roth IRA, you will be charged an additional 10% tax. There are some very specific exceptions to this additional tax, but you shouldn't count on withdrawing early if you can help it.

Oh, and one more fun thing to note (we use the term fun loosely around here) is that the deadline for making contributions to IRAs and 401(k)s is typically not until the tax deadline of the following year. So if you're wanting to reap the tax benefits of making retirement contributions on your 2021 taxes, you actually have until April 15, 2022 to do so.

Traditional IRA

Alright, let's get into some differences between the two most common IRAs. The biggest difference between a traditional and Roth IRA is that with a traditional IRA, you won't pay any taxes until you withdraw funds. This is a good strategy and retirement account to use if you think you will be in a lower tax bracket when you retire than you are now.

Contributing to a traditional IRA allows you to receive a tax benefit when you contribute since your yearly contribution is a deduction from your taxable income. However, if you or your spouse is covered by a retirement plan at work, then the deduction may be phased out (reduced) or eliminated. This will depend on your filing status and income.

Another key difference is that a traditional IRA has a minimum distribution starting at the age of 72, which means that you must take a yearly taxable withdrawal from your account.

Roth IRA

The big difference with the Roth IRA is that rather than delaying paying your taxes until you withdraw money when you're retired, you'll actually pay your taxes up-front and contribute after-tax dollars to your Roth IRA. This can make the Roth IRA the better choice for those who expect to be in a higher tax bracket when they retire than they are now.

Another difference is that your Roth IRA contribution is limited (phased out or eliminated entirely) based upon your income and filing status. For instance, in 2022, the amount you can contribute starts phasing out if you file as:

- Single, head of household or married filing separately with modified adjust gross income (MAGI) of more than $129,000

- Married, filing jointly with a MAGI of $204,000

Unlike with a traditional IRA, when your money is in a Roth IRA, you can make tax-free and penalty-free withdrawals on your contributions (but not your earnings!), and there are no minimum distribution requirements no matter your age.

Simplified Employee Pension IRA (SEP-IRA)

Now that we've discussed the two most common IRAs, there's another type of IRA that we should put on your radar. Rather than employees setting up their own IRAs, a SEP-IRA is instead set up by the employer. This type of plan can be established by a business of any size, self-employed included.

An SEP-IRA allows you, as an S corporation owner, to create a retirement account where you can contribute up to 25% of each employee's pay (including yours!) to the account (up to a maximum amount set by the IRS). And when you are the owner and the employee, this can be an effective way to limit the amount you pay for self-employment taxes.

For example, if you pay yourself a salary of $75,000 and contribute 25% of your salary to your SEP-IRA, then you're only paying self-employment taxes on $56,250. Additionally, the contributions you make to the SEP-IRA are deductible on the business' tax return, so that reduces the company's federal tax bill as well.

Other benefits of setting up a SEP-IRA are that it's easy to create, has low administrative costs, and allows for flexibility in how much the employer contributes. Also, employees are always 100% vested in the account, which means they always have ownership over their money.

One important thing to remember with this type of IRA is that the employer must contribute the same percentage of compensation for all eligible employees. Like with traditional IRAs, SEP-IRAs require minimum distributions starting at age 72.

An added bonus for this choice is that you can contribute to a SEP-IRA as an employer and also contribute to a traditional or Roth IRA as an employee.

Savings Incentive Match Plan for Employees (SIMPLE IRA)

Another IRA available to small businesses (less than 100 employees) is the SIMPLE IRA. With this plan, the employee makes pre-tax contributions up to a maximum amount set by the IRS. The employer can either choose to match that contribution for up to 3% of the employee's wages or set a 2% nonelective contribution for each eligible employee.

As an S corporation owner, having a SIMPLE IRA allows you to make pre-tax contributions as an employee and also earn the tax deduction for the contribution as the employer.

Similar to creating a SEP-IRA, the benefits of setting up a SIMPLE IRA are that it's easy to create and has low administrative costs. Also, employees are always 100% vested in the account, which means they always have ownership over their money.

The early withdrawal penalties are heftier with SIMPLE IRAs, however, as early withdrawals (before age 59 ½) taken in the first two years of the account being opened carry an additional tax penalty of 25% but then are subject to the 10% additional tax thereafter. Like with traditional and SEP-IRAs, SIMPLE IRAs require minimum distributions starting at age 72.

One-Participant 401(k)

A one-participant 401(k) is just what you'd think it would be based on that title: a 401(k) plan for a business owner without employees (except for a spouse). It can also be referred to as a Solo 401(k), Solo-k or Uni-k.

The one-participant 401(k) is a traditional 401(k) with the same rules and requirements as any other. For S corporation owners, this means that you will make an employee contribution, and the employer (also you!) will make an employer contribution up to a maximum amount set by the IRS.

An advantage to having a one-participant 401(k) is that the plan can allow you to make post-tax Roth IRA contributions. You will, however, be required to make minimum distributions from your one-participant 401(k) starting at age 72.

I thought I would wrap this up with a nice chart to help categorize the 5 types of retirement plans we discussed today. I hope you've found this information helpful and that it's motivated you to start planning for your financial future.