Getting paid time and a half for overtime work is a great perk for some employees. All the extra money on your paycheck is sure to bring a smile to your face, but are you really earning more money once Uncle Sam takes his share?

In today’s post, I’ll explain whether or not overtime pay is taxed more than regular time.

Is overtime pay taxed more than regular time pay?

No, overtime pay is not taxed more than regular time pay. So why have you heard people say that? Well, it’s likely people say this because when a person makes more money – from overtime or any other reason – they can be pushed into a higher tax bracket. This means that some of their money can then be taxed at a higher rate.

If I’m bumped into a higher tax bracket, is overtime pay taxed more than regular time pay?

The answer to this question is often why employees feel like they’re being cheated by the government when it comes to taxing their overtime pay. Before I give an explanation and examples, I want to be clear that if you make more money, then you make more money. You will never bring home less money by moving into a higher tax bracket or earning more money over the course of the year. In other words, you shouldn’t let which tax bracket you may end up in stop you from working overtime.

First of all, how tax brackets work is a highly misunderstood topic. I have a separate article and my team has created a video explaining how tax brackets work. Basically, to understand tax brackets, you need to know that when you make enough money to be pushed into a higher tax bracket, that higher tax rate does not apply to all of your income.

For example, let’s say there are two tax brackets: the first bracket applies to income up to $50,000 and has a tax rate of 10%, while the second bracket applies to income above $50,000 and has a tax rate of 20%. If you earn $40,000 per year, you would only pay 10% on all of that $40,000. But if you earn $60,000 per year, you would pay 10% on the first $50,000 and 20% on the remaining $10,000.

Should I be paid more for overtime hours than regular time hours?

Yes, there’s even a federal law about this! The Fair Labor Standards Act (FLSA) says that if you are paid hourly (not salaried unless under a certain amount), you should earn at least 1.5 times your regular pay for any hours you work over 40 hours each week. Some states even have additional laws that require employers to pay overtime amounts for any hours worked over 8 hours in a day.

Is it worth it for me to work overtime?

First, remember that the tax rate used to calculate your withholdings on each paycheck is determined by the information you provided your employer on your Form W-4. Another important note is that overtime pay and regular pay is all calculated at your normal wage bracket. However, if you receive a bonus, the IRS classifies that as supplemental income, and it is taxed at a set (usually higher) rate than the rest of your income.

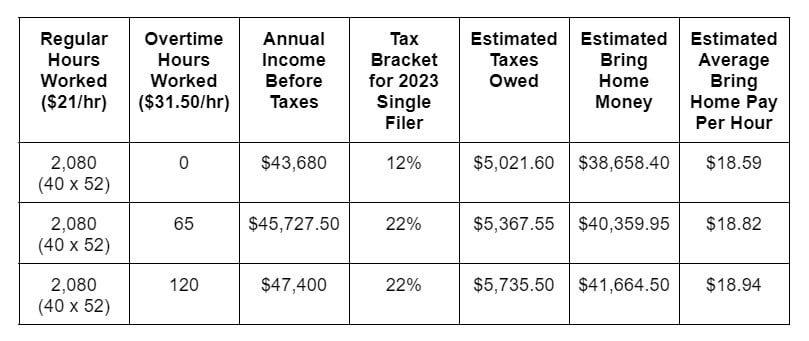

To determine whether it’s “worth it” for you to work overtime, let’s look at an example. Leslie works at a dress boutique where she makes $21 per hour and typically works 40 hours each week. However, in early spring and during the holiday season, she often works overtime making $31.50 per hour. Leslie creates this chart to estimate how much money she’ll bring home over the course of the year depending on how many overtime hours she works:

Leslie can use her calculations to see that the more she works, the more she earns. She can also see that her average bring home pay per hour continues to increase even though she’s bumped into a higher tax bracket when working overtime hours. If you need help figuring out your estimated pay based upon your wages and overtime throughout the year, you can always consult an accountant for help.

Also, be mindful that only you can determine whether or not working overtime is “worth it” for you. Take into consideration not only the number on your paycheck but also how much time you want to spend at work versus how much time you want to spend doing what you love with the people you love. Your mental health and happiness should be just as much a priority as achieving your financial goals.

The bottom line is that your overtime hours won’t be taxed more than your regular time hours, so don’t hesitate to pick up some OT when you can as long as you’re not sacrificing too much happiness to do so.