The small business owners’ simple guide to finances.

Feeling overwhelmed by your business’s finances? You’re not alone. The world of numbers, spreadsheets, and financial jargon can be intimidating, but it doesn’t have to be. We created the Know Your Worth course to give you the simple, clear guidance you need to take control of your business’s financial future.

We’ve made this course completely free because we believe every small business owner deserves a solid financial foundation. Our simple guide to finances will walk you through everything you need to know, in a way that’s easy to understand and even easier to apply.

Is your bookkeeping costing you? Learn how to avoid common financial pitfalls, categorize expenses correctly, and use your numbers to grow a more profitable business.

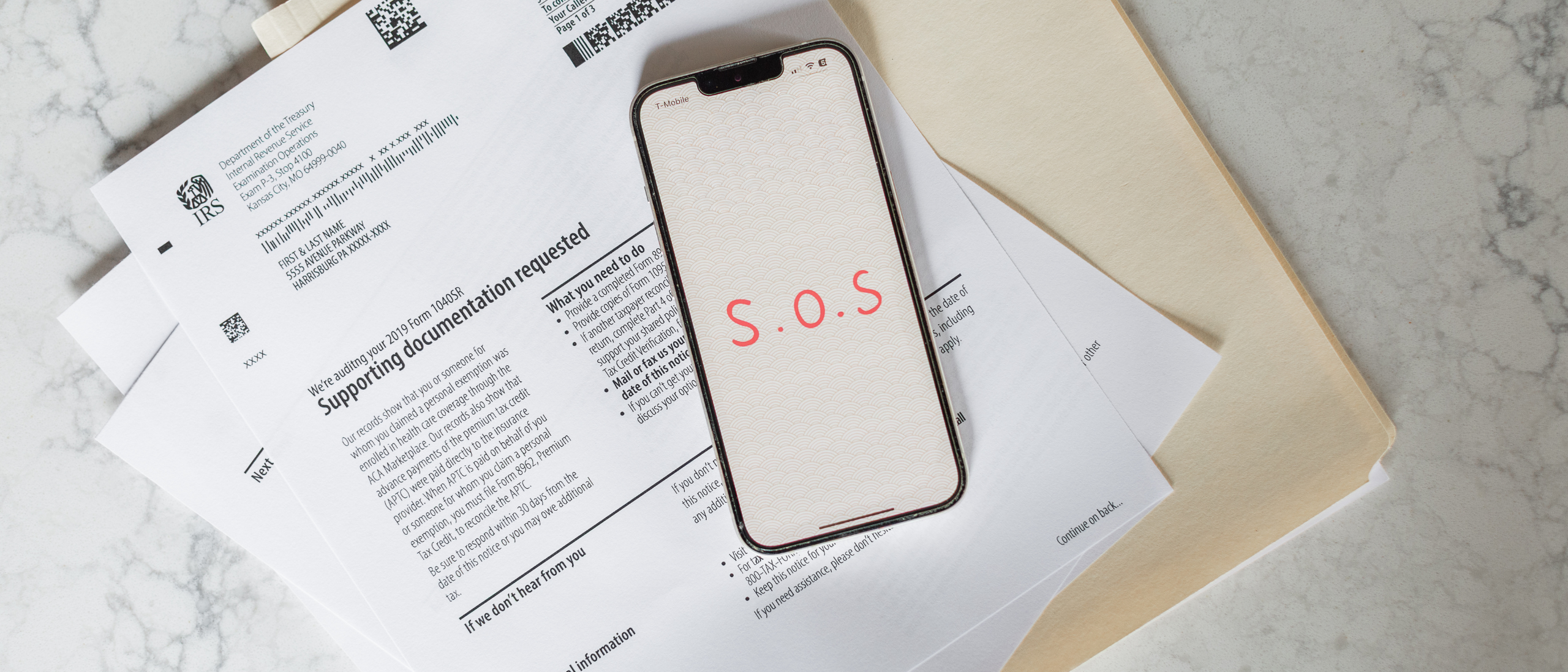

Received a letter from the IRS? Don't panic. Learn what common notices like CP2000, CP14, and CP75 mean, plus the exact steps you need to take to resolve them.

Can you deduct your gym membership as a business expense? Learn the IRS rules on fitness deductions, employee wellness programs, and what qualifies for small business owners.

Self-employment tax confusing? Discover the automatic deduction that lowers your taxable income. Learn what the self-employment tax deduction is, how it works, and how this built-in tax break helps small business owners keep more money. Simplify your taxes today!

New USPS postmark rules could lead to IRS penalties. Learn how the December 2025 change affects your tax deadlines and how to protect your filings with e-filing or certified mail.

The Section 199A deduction can save small business owners up to 20% on taxes. Learn how QBI works, who qualifies, and how to choose the right entity to maximize your savings.

Small business bartering and taxes: Learn how to report bartering income to the IRS, calculate fair market value, and record transactions in your bookkeeping.

Highest US Tax Rate EVER? Discover the 94% marginal income tax rate from WWII, how it compares to today's 37% top rate, and why understanding tax brackets is crucial for small business owners. Learn to plan for growth and minimize your tax bill!

Helping a kid start a business? Learn the essential tax rules and IRS requirements for young entrepreneurs, including bank accounts, bookkeeping, and filing Schedule C.

U.S. Expat Taxes Guide: Digital nomads and Americans living abroad, don't miss the filing deadline! Learn about the Foreign Earned Income Exclusion (FEIE), Foreign Tax Credit (FTC), FBAR, and FATCA reporting to avoid double taxation and IRS penalties.