With tax season quickly approaching, it’s a good time to remind everyone that the IRS doesn’t initiate contact with taxpayers by email, text messages or social media channels to request personal or financial information.

Please share this with your friends and family, especially those who are most likely to be targeted by these scammers.

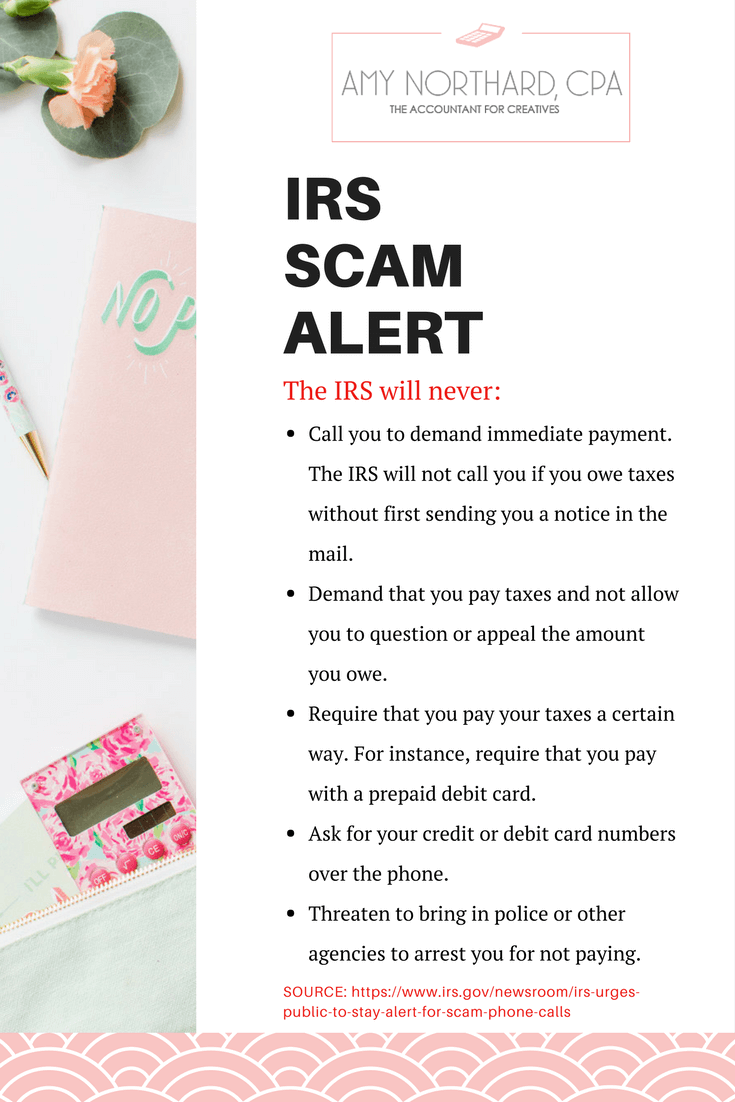

The IRS will never:

- Call you to demand immediate payment. The IRS will not call you if you owe taxes without first sending you a notice in the mail.

- Demand that you pay taxes and not allow you to question or appeal the amount you owe.

- Require that you pay your taxes a certain way. For instance, require that you pay with a prepaid debit card.

- Ask for your credit or debit card numbers over the phone.

- Threaten to bring in police or other agencies to arrest you for not paying.

If you receive one of these calls, please consider collecting their stated name, the phone number they are calling from and contacting TIGTA and the Federal Trade Commission.

- Contacting TIGTA to report the call. Use their “IRS Impersonation Scam Reporting” webpage. You can also call 800-366-4484.

- Reporting the call it to the Federal Trade Commission. Use the “FTC Complaint Assistant” on FTC.gov. Please add “IRS Telephone Scam” in the notes.