The IRS provides online tax tools like a tax transcript to help all of us check the status of our tax returns and tax refunds.

These tools can be very helpful, but some of the codes that the IRS enters on the tax transcript can cause confusion. In today’s post, I’ll cover IRS Code 806 and explain why you’ll see it on your tax transcript.

What is a tax transcript?

An IRS tax transcript can show you most transaction codes and step-by-step line items that apply to your tax return if you filed a Form 1040, Form 1040A, or Form 1040EZ. Tax transcripts for the current tax year and for returns processed in the previous three years are available for free from the IRS. Your tax transcripts can be requested online, by phone, or by mail.

Many people access their tax transcript for free online when they’re trying to determine when they’ll receive their tax refund.

What is a transaction code?

An IRS transaction code (TC) is a three-digit code that identifies a step in the processing of a tax return. Transaction codes are posted to each person’s Master File on their IRS tax account which means that you will see them on your tax transcripts.

What is IRS Code 806?

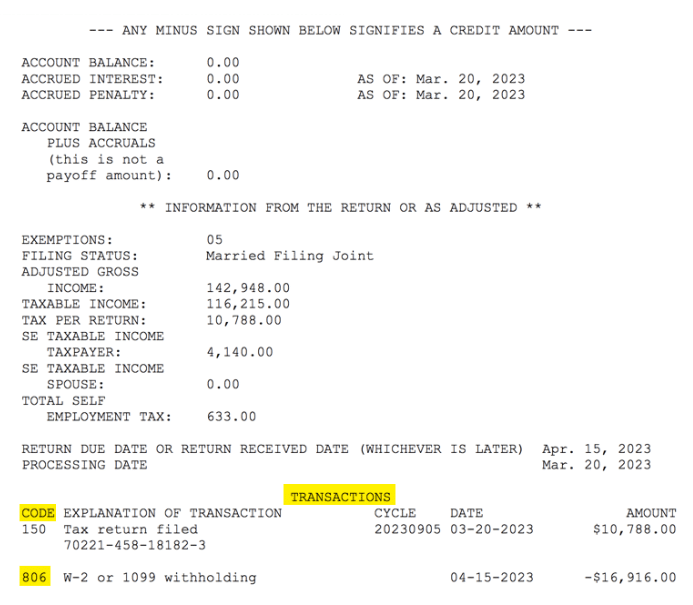

The IRS’ official title for transaction code 806 is “Credit for Withheld Taxes and Excess FICA.” If you see IRS Code 806 on your tax transcript, the amount you see along with the code corresponds with the amount of federal taxes and FICA taxes that your employer(s) withheld from your paychecks throughout the tax year. This amount should match the amount you or your tax preparer entered on line 25d of your Form 1040.

An important note here is that the amount that is listed along with Code 806 on your transcript is not the amount you will receive for a tax refund. It also doesn’t correspond to a tax bill amount.

Where on my tax transcript would I see IRS Code 806?

To find Code 806 on your tax transcript, you’ll look for the section labeled TRANSACTIONS. The first column in that section is labeled CODE. In that column is where you’ll look for IRS Code 806. Here’s an example of a tax transcript with IRS Code 806:

What should I do if I have IRS Code 806 on my tax transcript?

If you see IRS Code 806 on your tax transcript, you’re not required to take any action. It is a good idea to check the amount listed for that code to make sure it matches the amount of federal taxes withheld that you reported on your Form 1040, line 25d.

If you find that the amount listed on your tax transcript doesn’t match the amount listed on your Form 1040, then you may want to contact an accountant for help in figuring out why and determining what your next steps should be.

What else should I know about checking my tax refund status?

My other articles about tax refund status can help answer your questions about when you should expect to receive your refund:

- Check Tax Refund Status

- Your Tax Return Is Still Being Processed

- Tax Topic 152: Is My Refund Delayed?

- What Day and Time Does the IRS Deposit Refunds?

- How Do I Get a Tax Transcript from the IRS?

- How Do I Reach a Real Person at the IRS?

What do the other IRS codes on my tax transcript mean?

I have written several articles to help you understand the other IRS transaction codes as well: