If you’ve submitted your tax return and have been checking your online IRS tax transcript, you may have noticed an IRS Code 150. So what does Code 150 mean? Read on to find out.

What is Code 150?

After submitting your IRS tax return, you’ll be able to access a free tax transcript online. This transcript lists IRS cycle codes and transaction codes that can help you figure out what stage your return is at in the IRS process.

If you see a Code 150 on your transcript, that tells you that your return has been processed and that the IRS has determined your final balance, including what you may owe or what they may owe you. That’s it. Code 150 doesn’t mean that you definitely owe money or that you are being audited or anything else you may have panicked about after reading speculation online.

Where on my tax transcript would I see an IRS Code 150?

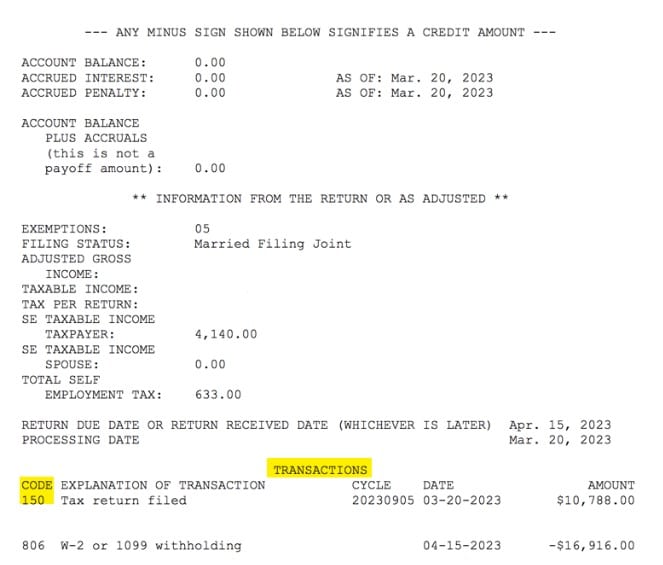

When looking at your tax transcript, find the TRANSACTIONS section. In that section is a column labeled CODE. That’s where you’ll find IRS Transaction Code 150 once your tax return is finished processing. Here is an example of where you’ll see Code 150:

Is the date next to Code 150 the day I will get my refund?

No, the date on the entry line with Code 150 doesn’t help you determine when you’ll receive your refund. That date is used by the IRS as an “effective date,” which really doesn’t mean anything to you or your money.

Does my tax transcript tell me when I will get my tax refund?

Yes, your tax transcript can tell you when you will receive your refund, but you will need to understand how to read the codes in order to figure that out. I explain all of that in this post: What Is an IRS Cycle Code?

If you elected to get your refund through direct deposit and you’re looking to find out exactly when you’ll see your refund in your bank account, then this post can answer that question: What Day and Time Does the IRS Deposit Refunds?

Is the amount next to Code 150 how much I owe in taxes?

The amount listed on the transaction line for Code 150 is your total tax due. This doesn’t mean you owe this amount. In fact, if you’ve been paying taxes throughout the year through paycheck deductions, then you should have paid this amount already.

If you paid more than the total tax due amount throughout the year, you’ll receive a refund. If you paid less than the total tax due, then you’ll obviously need to pay that amount to the IRS by the due date. If your tax return was completed correctly, the amount listed with the Code 150 should match what was entered on line 24 of your Form 1040.

Who can help me figure out my tax transcript?

If you have questions about your tax transcript, you can follow my directions for speaking to a real person at the IRS who should be able to help you.

For more information about tax transcripts and refunds, check out my related posts: