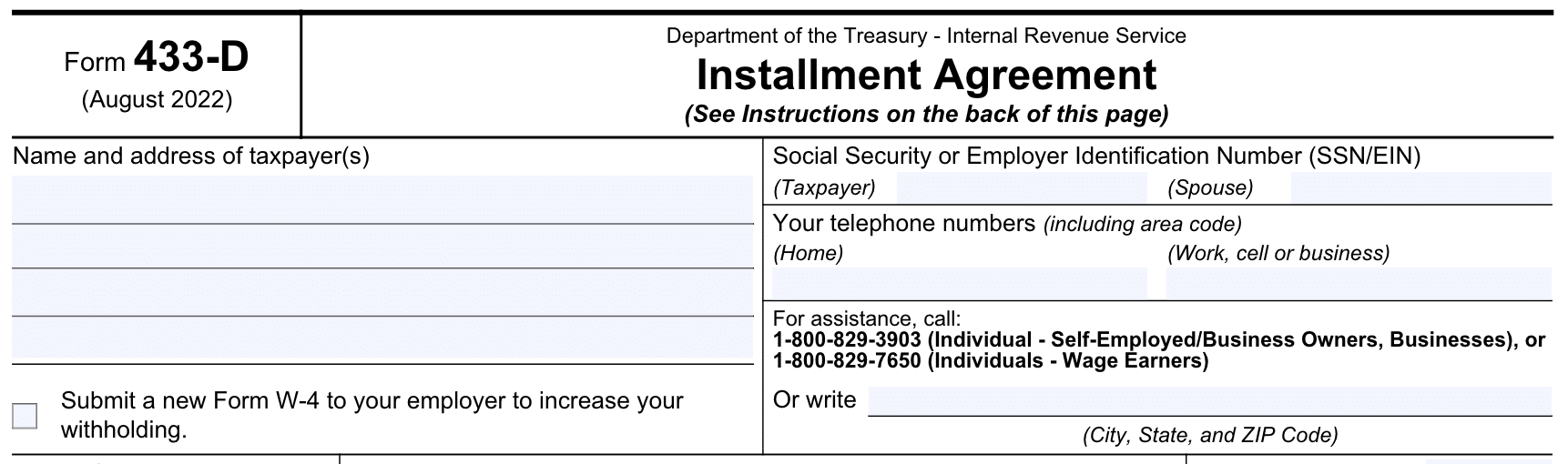

In order to finalize an IRS payment plan or to set up direct debit payments, you’ll likely need to complete IRS Form 433-D.

In today’s post, I’m providing step-by-step instructions for completing and submitting this form. I’m also outlining why it’s advantageous to make your IRS installment payments by direct debit from your bank account.

If you’ve requested a payment plan, which the IRS refers to as an “installment agreement,” then you’ve likely used IRS Form 9465 to make that request. If you now need to finalize your agreement or provide the IRS with banking information and authorization for direct debit of your installments from your bank account, then you may also need to complete and submit IRS Form 433-D.

Sometimes the IRS will send you Form 433-D with some of the fields already completed. Sometimes you will need to complete the entire form yourself. Either way, you can use the following steps to enter information on your IRS Form 433-D.

Step 1: Gather Information

Before you begin filling out IRS Form 433-D and setting up your direct debit payments, make sure you have the following information:

- Bank name

- Bank routing number

- Bank account number

- Type of tax you owe

- Dates of tax period you’re paying for

- Amount of taxes you owe

- Your Social Security Number (SSN) or Employer Identification Number (EIN)

- Your spouse’s SSN, if applicable

Step 2: Download the Most Recent Form

If the IRS hasn’t sent you a pre-populated form, then you should download the form directly from the IRS’ website. If you Google the form name, make sure you don’t click on some other website that’s trying to get your information or money. Downloading the form directly from the IRS will also ensure you get the most recent version of the form

You can either print the form and fill it out with black pen or you can use your computer to fill in the form and then print it out.

Step 3: Enter Personal Information

In the top 2 boxes on the form, you’ll enter the following personal and contact information:

- Your name as it appears on your tax return

- Your spouse’s name (if applicable) as it appears on your tax return (enter on the same line as your name)

- Your current address

- Your SSN or EIN as well as your spouse’s SSN, if applicable (only enter an EIN rather than an SSN if an EIN is associated with the taxes owed)

- Your daytime phone number(s)

Only check the box to submit a new Form W-4 to your employer if you wish to do so in order to increase your withholding during future tax periods.

Step 4: Enter Tax Information

In the next 3 boxes, you’ll enter the following tax information:

- In the “Kinds of taxes” box, you’ll enter the form number(s) for the type of taxes you owe. For instance, if you owe income taxes, you’d enter “1040.”

- In the “Tax periods” box, you’ll enter the time period for which you owe taxes. This is usually a year. For instance, if you owe income taxes for the 2024 tax year, you would enter “2024.”

- In the box asking for the amount you owe, you’ll want to enter the most up-to-date and accurate number you can. The best way to get this number is to look in your online account or to call the IRS. This way, you can enter today’s date and the exact amount you owe. However, if you have a recent notice from the IRS, you can enter the date and amount owed from that notice. Do not round the number.

Step 5: Enter Payment Installment Information

In the next 5 boxes, you’ll enter the following payment information:

- The first money amount and date lines require you to enter the amount you are paying when you submit the form. The date you enter should be today’s date or the date you are submitting the partial payment.

- The next money amount line is for you to enter the amount you’ll pay each month. This should be a realistic amount based on your current financial situation. If you need help with this number or don’t think you can pay the amount the IRS is requesting, contact an accountant to help.

- You’ll then enter the date each month you’d like to make your payment. You can choose any day from 1 to 28. The installment payment will need to be paid by that same day each month. If you’re setting up direct debit, then choose a day in the month where you will have enough funds in your account to pay your installment.

- If you plan to increase or decrease the amount of your installment, enter the date for that fluctuation as well as the new amount you plan to pay.

- Put your handwritten initials (do not type) in the initial box to signify that you agree to the payment terms you’ve entered on the form.

Step 6: Enter Direct Debit Information

If you’re setting up direct debit for your payments, in the next 7 boxes, enter the banking information needed:

- Enter your bank’s routing number, which is 9 numbers in length. You can usually verify the routing number online, but if you’re having trouble finding it, it’s best to call your bank to make sure you’re entering the correct number.

- Enter your bank account number that can be up to 17 characters. You should include hyphens but leave out any other symbols. If you have unused boxes, just leave those blank.

- Check the box for unable to make debit payments only if that applies to you.

- Sign and date the form.

- Enter your corporate officer or partner title, if applicable.

- Your spouse also needs to sign and date the form, if applicable.

Step 7: Mail the Form

Before you mail the form, make sure that you have completed the “Taxpayer’s Copy” on page 3 so that you have that information for your records. If you’re completing the form digitally, of course you can save a digital copy as well.

If the form was sent to you by the IRS, you should mail the first page of the completed form back to the address on the letter that came with the form. If you downloaded the form yourself, then you should mail the completed form to the address shown in the “For assistance” box at the top of the form.

What are the advantages to paying the IRS in direct debit installments?

There are several reasons why you may want to repay the IRS through direct debit from your bank account rather than by check, money order, or online payment:

- You’re less likely to default on your repayment plan, which will save you money in penalties and interest in the long run.

- The IRS lowers the user fee it charges for installment plans if you opt for direct debit.

- If the IRS has placed a lien on your property, they may remove the lien if you have entered in a repayment plan with them and have chosen direct debit payments.

What else should I know about the Form 433-D Installment Agreement?

First of all, make sure you read the terms and authorization statements on all of the pages of the Form 433-D. Here are some important terms to keep in mind:

- For a regular installment plan, you’ll be charged a $225 fee. For a direct debit installment plan, you’ll be charged a $107 fee. If you are a low-income taxpayer, which means your income is at or below 250% of the federal poverty level, then you may have a reduced user fee, no user fee, or be reimbursed your user fee once your debt is paid.

- If you default on this agreement, and the IRS then agrees to reinstate the agreement, you’ll pay a $89 reinstatement fee. This reinstatement fee may also be reduced or reimbursed for low-income taxpayers.

- Your agreement with the IRS will generally remain in effect until you have paid in full, including penalties and interest.

- If you can’t make a scheduled payment, you need to contact the IRS immediately.

- If the IRS determines that your financial condition (or ability to pay) has changed, they can terminate or change your agreement.

- If you don’t file and pay any federal taxes you owe on time while your installment agreement is in effect, the IRS may terminate the agreement.

- If the IRS asks you for updated financial information, you must provide it.

What should I include on my check or money order for 433-D installment payments?

If you choose to write and send checks or money orders to make your installment payments to the IRS, make sure to include all of this information:

- Make the check or money order payable to “United States Treasury.”

- Include your SSN or EIN.

- Enclose a copy of the reminder notice, if you have one. Even if you didn’t receive a reminder notice, you should still send your payment.

- Use the envelope provided by the IRS, if applicable.

- Write the type of tax, the tax period, and the words “Installment Agreement” on your check or money order. For example, write “1040, 2024, Installment Agreement.” If there’s more than one tax period on your agreement, then include the oldest one.

How can I pay my IRS installments?

You can make your installment payments to the IRS by:

- Direct debit from a bank account (see benefits of direct debit above)

- Mailing a check or money order to the IRS

- Electronic payments at www.IRS.gov/Payments

What happens after I submit IRS Form 433-D?

Once the IRS receives your completed form, they will process your request. If they agree with your installment details, they will send you a confirmation letter that will include all of the details of your installment agreement. If you have opted for direct debit payments, the confirmation letter will provide the date for your first direct debit payment.

While you’re waiting on your confirmation letter from the IRS, you may find one of these other posts useful: