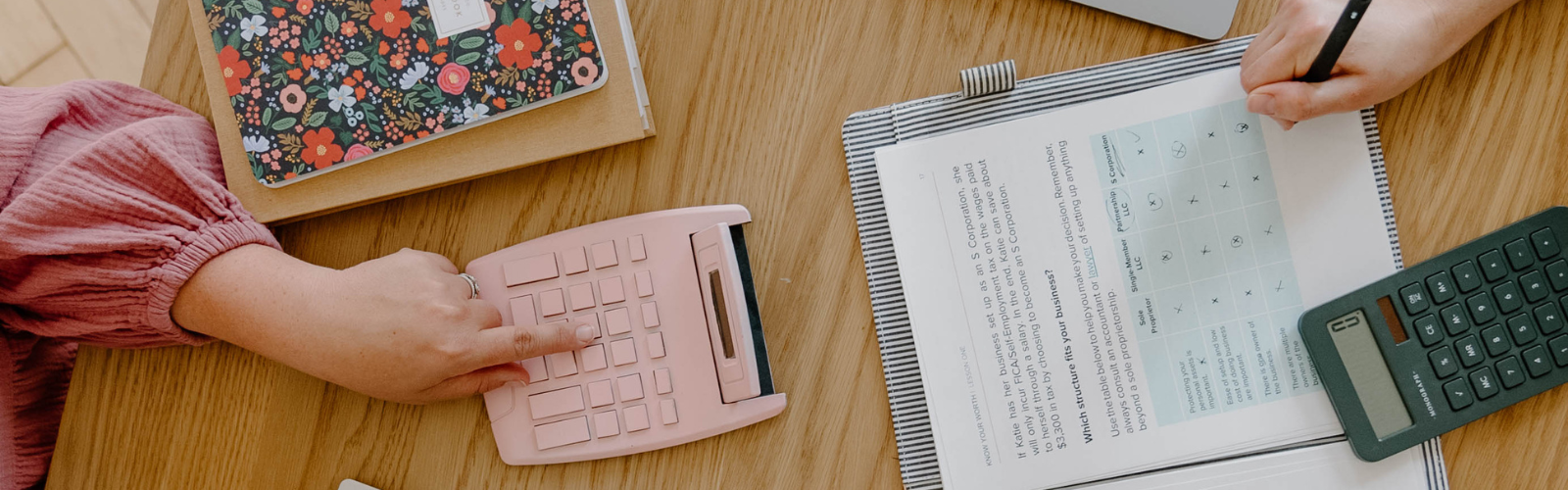

Navigating community property laws and their impact on your taxes can be complex. This guide explains how community property affects your tax bill in states like California, Texas, and more, covering federal taxes, filing status, classifying property, small businesses, and registered domestic partnerships. Learn how to minimize your tax burden and make informed financial decisions with expert tips.