Once you’ve submitted your IRS tax return, you can access a free tax transcript online.

This transcript provides you with an IRS cycle code that can be used to determine when you will receive your tax refund. In this post, I’ll help you crack that code so you know when to expect your money.

What is an IRS cycle code?

The IRS cycle code is an eight-digit number that you can find on your online tax transcript once your return has been posted to the IRS Master File. If you see a cycle code along with transaction code 150, you’ll know that your tax return is being processed. You can use your cycle code along with the transaction codes on your transcript to determine when you will receive your tax refund.

How do I access my tax transcript?

To access your tax transcript online, you’ll go to the Get Your Tax Record page on the IRS website. From there, you’ll create your online account if you don’t have one already. Once signed in, you’ll click the link to View Tax Records and then click the GET TRANSCRIPT button. From the dropdown menu, you’ll pick a reason for needing a transcript. You do not need to enter a customer file number. Just click the GO button.

You’ll then see a list of several different types of transcripts from previous tax years. You’ll want to click on the hyperlink for the Account Transcript of the year you want to view.

How do I find my IRS cycle code?

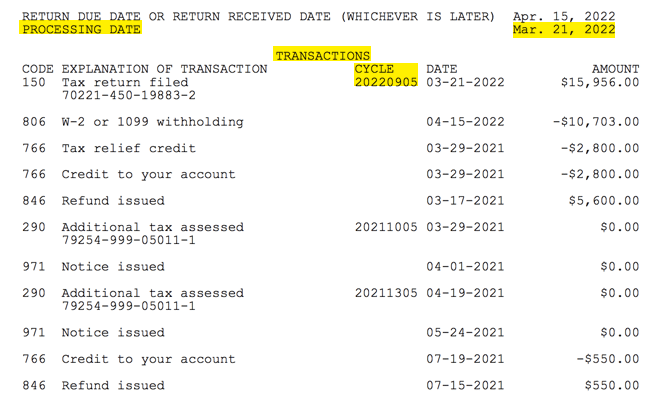

Once you’ve pulled up your tax transcript, scroll down to the TRANSACTIONS section of the document. There you’ll find a column labeled CYCLE that will provide your IRS cycle code. The cycle code’s numbers are made up of the year, week of the year, and day of the week, in that order.

In the image below, the cycle code is 20220905. This indicates that the code is for the 5th day in the 9th week of the year in 2022. However, the 5th day doesn’t mean Friday. The IRS starts its code week on a Friday, so the 05 actually corresponds with Thursday. You’ll want to remember this for later.

What can my IRS cycle code tell me?

The first thing the cycle code tells you is whether you were placed into a daily or weekly batch cycle. Here’s where code cracking comes into play. If your cycle code ends in 01, 02, 03, or 04, you’ve been placed in a daily batch cycle. If your cycle code ends in 05, you’ve been placed in a weekly batch cycle.

If you’re in a daily batch cycle, you can expect to see transcript updates on Tuesdays and updates to your Where’s My Refund status on Wednesdays. If you’re in a weekly batch cycle, you can expect to see transcript updates on Fridays and updates to your Where’s My Refund status on Saturdays.

Another thing you’ll notice on your transcript is a PROCESSING DATE. This is when the IRS expects to have your return and refund processed, but obviously, there are no guarantees. This date is typically 21 days after the date that corresponds to your cycle code, but as you can see in the example above, that’s not always the case.

Also, don’t be surprised if you see your cycle code change. That happens sometimes. Unfortunately, if you receive a new cycle code, it’s generally due to a delay in processing and will result in a delay in your refund as well.

How does the IRS cycle code tell when I’ll receive my tax refund?

The cycle code alone cannot tell you when you’ll receive your refund. However, once you see the transaction code 846 on your transcript, then you know that your refund has been issued. At that point, you can use the cycle code to determine what day you will likely get your money. Here’s how that works:

IRS Cycle Code Refund Date

| If you have transaction code 846 on your transcript + your cycle code ends in: | You’ll likely receive a direct deposit refund on the next: |

|---|---|

| 01 | Monday |

| 02 | Tuesday |

| 03 | Wednesday |

| 04 | Thursday |

| 05 | Friday |

If you aren’t going the direct deposit route, you’ll probably receive your check in the mail 5-7 days after the day in the chart above.

Of course, when you’ll be able to access your funds depends on many factos, including your bank’s processing time. To help with that, I’ve explained how you can better determine the day and time you’ll receive your refund using the Where’s My Refund site.

Remember that there are many different reasons your refund can be delayed during or after processing. However, now you know how to use your IRS cycle code and transaction codes to help determine when you’ll see your money.