Sometimes the IRS will send you a notice that is a real head-scratcher. The IRS Letter 2645C is a perfect example of that.

In today’s post, I’ll explain IRS Letter 2645C and what you should do if you’ve received it.

Why did I receive IRS Letter 2645C?

IRS Letter 2645C is a generic letter the IRS sends out if they need more time to process whatever it is they’re processing for you. This could be a response to a telephone call you placed, a payment you sent, a letter or form you sent, a penalty abatement you requested, an installment agreement you submitted, or any other number of items.

If you’re not sure what the IRS is processing for you, then this letter might not be of much help, but you’ll likely know what business you currently have open with the IRS.

What should I do if I receive IRS Letter 2645C?

First of all, you should know that if you’ve received an IRS Letter 2645C, you don’t need to take any action. In fact, the letter will usually tell you that no further information is needed from you at this time. The letter will also let you know how much time the IRS thinks they’ll need to finish processing your request, form, or payment. The timeframe given is usually between 30 and 90 days.

If you feel the timeframe given is too long, if you’re not sure why you received the letter, or if you have other questions regarding the matter at hand, you can always call and speak to a real person at the IRS.

However, since the IRS has given you a timeframe for when they will be able to finish processing your request, the representative you speak to on the phone may not be able to offer much more information. If you feel the delay in processing is creating a problem for you, you can contact the Taxpayer Advocate Service or a CPA to see if they can help you resolve the matter more quickly.

Another option that is typically listed in the IRS Letter 2645C is that you can write to the address listed on the first page of your letter. If you choose this option, make sure you include a copy of your letter, your telephone numbers, and the hours you can be reached.

The IRS often sends a follow-up letter when they have finished processing or if they have determined they need more information from you, so be on the lookout for that one as well.

What does IRS Letter 2645C say?

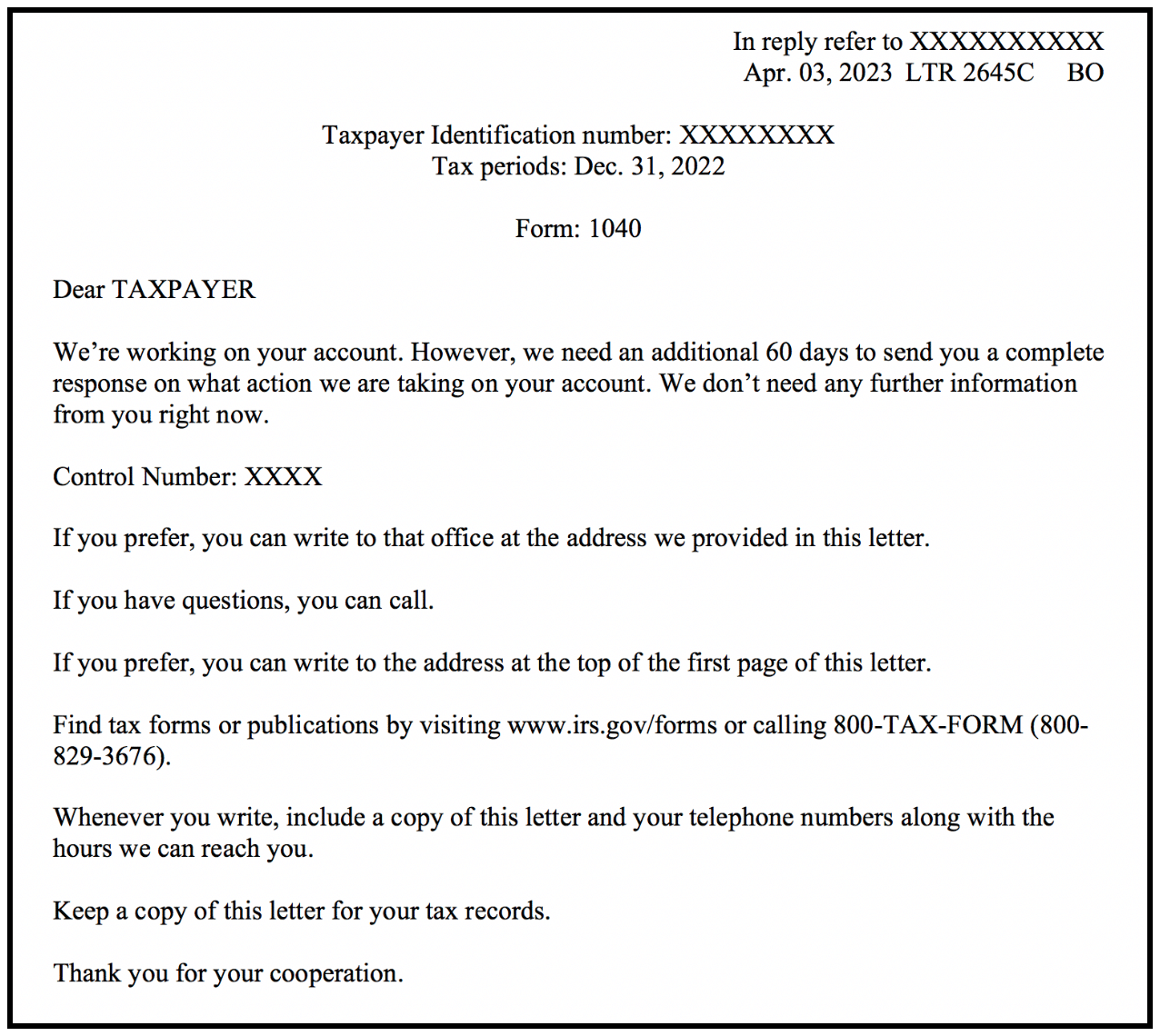

Here’s an example of what IRS Letter 2635C might say. Even though it is a form letter, there are variations to what might be included in your letter.

IRS Letter 2645C Example